Government Expenditure and Revenue Scotland 2022-23

Government Expenditure and Revenue Scotland (GERS) is a National Statistics publication. It estimates the revenue raised in Scotland and the cost of public services provided for the benefit of Scotland.

This document is part of a collection

Chapter 4: Devolved Revenue and Expenditure

Introduction

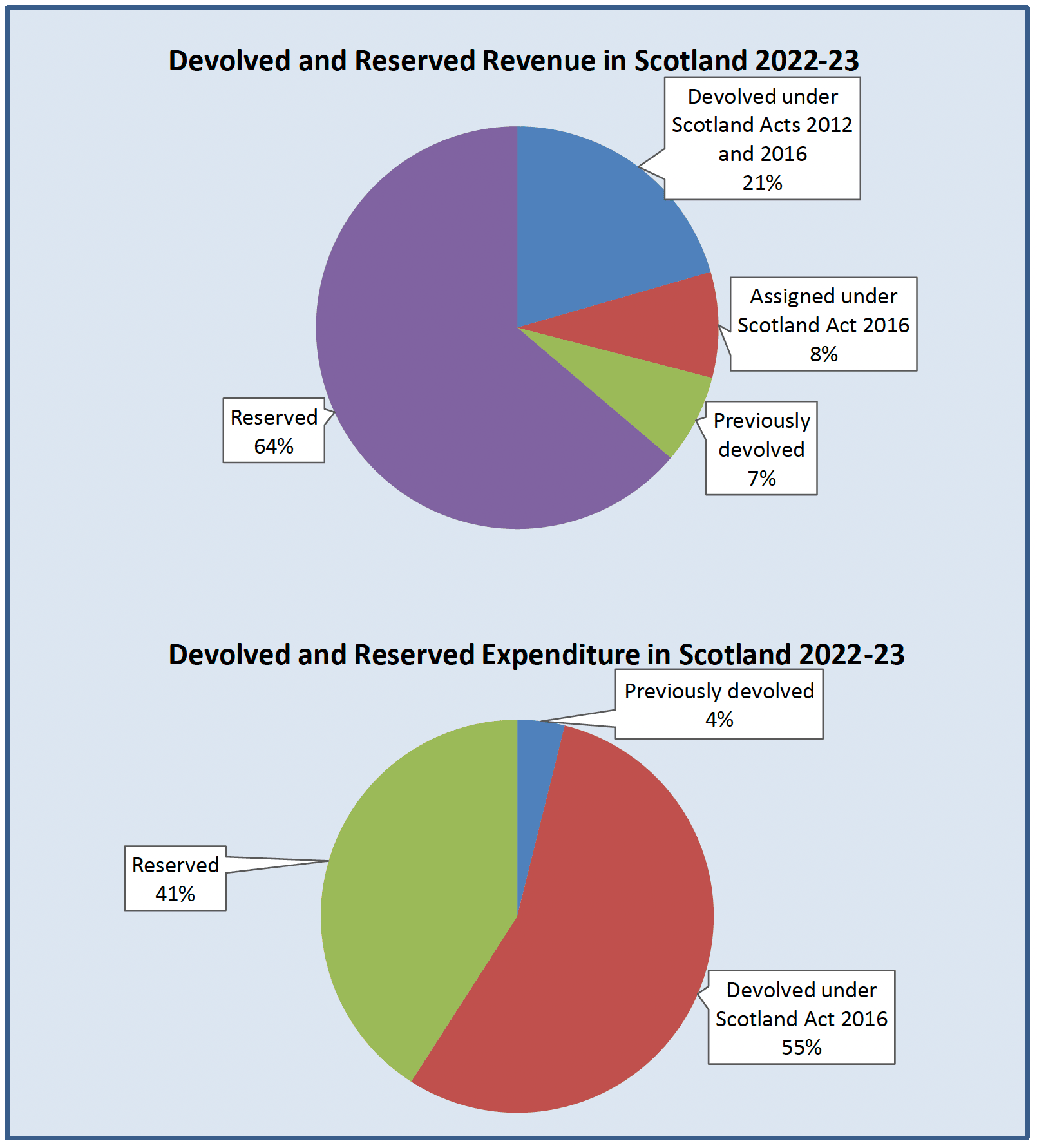

This chapter provides information on the amount of public sector revenue and expenditure currently devolved to Scotland as well as that to be devolved under the Scotland Act 2016.

Devolved Revenue

The table below sets out revenue raised in Scotland from taxes currently devolved to the Scottish Parliament. Total devolved tax revenue in 2022-23 is estimated at £21.3 billion.

| £ million | |||

|---|---|---|---|

| 2020-21 | 2021-22 | 2022-23 | |

| Council tax | 2,564 | 2,640 | 2,760 |

| Non-domestic rates | 1,816 | 2,108 | 2,848 |

| Land and buildings transaction tax (devolved from 2015-16) | 517 | 814 | 858 |

| Scottish landfill tax (devolved from 2015-16) | 107 | 122 | 110 |

| Non-savings and non-dividend income tax liabilities (devolved from 2016-17)1 | 11,948 | 13,342 | 14,765 |

| Total devolved taxes | 16,952 | 19,026 | 21,341 |

1 This table shows Scottish Rate of Income Tax liabilities rather than receipts in a given year. They are therefore on a different basis to the estimates of total Scottish income tax receipts in Table 1.1. The figure for 2022-23 is the SFC forecast from May 2023.

Further devolution of taxes is due to continue, with Air Passenger Duty and Aggregates Levy due to be devolved following the Scotland Act 2016. As well as further tax devolution, the Scotland Act 2016 allows for the first 10p of the standard rate of VAT receipts and the first 2.5p of the reduced rate of VAT receipts in Scotland to be assigned to the Scottish Government, although policy decisions will remain reserved. The transition period for VAT assignment began on 1 April 2019.

As these taxes are not yet devolved there is no outturn data associated with them, and the table below shows the estimated historical revenues from these taxes.

| £ million | |||

|---|---|---|---|

| 2020-21 | 2021-22 | 2022-23 | |

| Air passenger duty (date of devolution to be decided) | 26 | 95 | 252 |

| Aggregates levy (date of devolution to be decided) | 57 | 58 | 59 |

| VAT assignment (in transition from 2019-20) | 4,842 | 5,877 | 6,627 |

Note: Assigned VAT receipts are 50% of total receipts in all years. Whilst this is appropriate when the standard rate of VAT is 20%, VAT on the hospitality and other industries was reduced to 5% in July 2020, and then increased to 12.5% in October 2021. This is not reflected in the current estimates. HMRC will set out more detail of Scottish assigned VAT relating to 2020-21 in September 2022.

Further information on the planned devolution of taxes to the Scottish Government is available in the fiscal framework agreement between the Scottish and UK Governments.[25] Further information on the funding received by the Scottish Government is set out in the Fiscal Framework Outturn Report.[26]

Devolved Social Security

The table below shows the expenditure in Scotland from social security benefits devolved to the Scottish Parliament prior to implementation of Scotland Act 2016.

| £ million | |||

|---|---|---|---|

| 2020-21 | 2021-22 | 2022-23 | |

| Council tax reduction | 374 | 358 | 374 |

| Scottish welfare fund | 49 | 54 | 56 |

| Discretionary housing payments | 76 | 79 | 79 |

| Total | 500 | 490 | 509 |

As social security benefits are devolved to the Scottish Government, they often initially continue to be administered by the Department for Work and Pensions under an Agency Agreement. The table below shows the latest available figures for social security spending which is due to be devolved to the Scottish Government under the Scotland Act 2016.

| £ million | |||

|---|---|---|---|

| 2020-21 | 2021-22 | 2022-23 | |

| Administered by Social Security Scotland | |||

| Best Start Grant (previously Sure Start maternity grant1) | 18 | 14 | 21 |

| Best Start Foods | 11 | 14 | 13 |

| Funeral Support Payment (previously Funeral Payment2) | 11 | 10 | 10 |

| Scottish Child Payment | 6 | 56 | 213 |

| Carer’s Allowance Supplement | 59 | 58 | 44 |

| Child Winter Heating Assistance | 3 | 5 | 6 |

| Winter Heating Payment (previously Cold Weather Payments3) | 21 | 0 | 20 |

| Child Disability Payment | - | 5 | 215 |

| Adult Disability Payment | - | 0 | 99 |

| Job Start Payment | 0 | 1 | 0 |

| Child Carer's Grant | 1 | 1 | 1 |

| Administered by Department and Work and Pensions under an Agency Agreement | |||

| Attendance Allowance | 528 | 515 | 554 |

| Carer’s Allowance | 296 | 294 | 314 |

| Disability living allowance | 722 | 686 | 524 |

| Personal independence payment | 1,626 | 1,739 | 1927 |

| Industrial injuries disablement benefit | 83 | 80 | 78 |

| Severe disablement allowance | 7 | 7 | 6 |

| Benefits yet to be devolved | |||

| Winter fuel payment | 169 | 171 | 173 |

| Total expenditure on social security to be devolved | 3,561 | 3,642 | 4,148 |

Notes:

1 Sure Start maternity grant was replaced in Scotland by the Scottish Government’s Best Start Grant on 10 December 2018.

2 Funeral Payments were replaced in Scotland by the Scottish Government’s Funeral Support Payments in September 2019

3 Cold Weather Payments were replaced in Scotland by the Scottish Government’s Winter Heating Payment in February 2023.

Further information on the planned devolution of taxes and social security to the Scottish Government is available in the fiscal framework agreement between the Scottish and UK Governments.[27] Further information on the funding received by the Scottish Government is set out in the Fiscal Framework Outturn Report.[28]

Summary of current and proposed devolved powers

The table below shows estimates of devolved receipts and expenditure before and after the implementation of the Scotland Acts 2012 and 2016.

| Before Scotland Acts 2012 and 2016 | After Scotland Acts 2012 and 2016 | |

|---|---|---|

| Non-saving non-dividend income tax liabilities | - | 14,764 |

| Council tax | 2,760 | 2,760 |

| Non-domestic rates | 2,848 | 2,848 |

| Land and buildings transaction tax | - | 858 |

| Scottish landfill tax (devolved from 2015-16) | - | 110 |

| Air passenger duty (date to be decided) | - | 252 |

| Aggregates levy (date to be decided) | - | 59 |

| Total devolved taxes | 5,608 | 21,651 |

| Devolved taxes as % of non-North Sea Scottish revenue | 7% | 28% |

| as % of revenue incl geographical share of North Sea revenue | 6% | 25% |

| Assigned VAT (in transition from 2019-20) | - | 6,627 |

| Total devolved and assigned taxes | 5,608 | 28,278 |

| Devolved and assigned taxes as % of non-North Sea Scottish revenue | 7% | 36% |

| as % of taxes incl geographical share of North Sea revenue | 6% | 32% |

| Devolved expenditure including housing benefit1 (HB) | 58,856 | 63,004 |

| Devolved taxes as % of estimated devolved expenditure | 10% | 34% |

| Devolved and Assigned taxes as % of estimated devolved expenditure | 10% | 45% |

1 In GERS and the CRA, housing benefit is included in Scottish local government spending, as they make the payments to recipients, although it is set centrally and funded by the Department for Work and Pensions. Depending on definitions adopted, it could either be excluded or included in devolved expenditure.

Contact

Email: economic.statistics@gov.scot

There is a problem

Thanks for your feedback