Scottish Budget: 2024 to 2025

The Scottish Budget sets out the Scottish Government’s proposed spending and tax plans for 2024 to 2025, as presented to the Scottish Parliament.

Chapter 2 Economic and Fiscal Context

Introduction

This chapter provides an update on the latest insights on the Scottish economy[1] and a summary of the latest economic forecasts from the Scottish Fiscal Commission (SFC) and the Office for Budget Responsibility (OBR)[2].

Challenging economic and fiscal context

The economy has faced a succession of significant shocks in recent years, with the inflation shock arising from the war in Ukraine following on from those from Brexit and the pandemic. Collectively, they have led to a range of economic and fiscal risks which have evolved over the past couple of years as the economy has continued to recover, adjust and adapt to these persistent challenging conditions and elevated levels of uncertainty.

While the sharp rise in inflation in 2022 linked to the war in Ukraine and its impact on energy and wider commodity prices has eased over 2023, consumer prices in 2024-25 are still expected to be around twenty per cent higher than they were just three years ago. This has led to a significant fall in the purchasing power of households in recent years as wages failed to keep pace with inflation. While inflationary pressures have been widespread across both goods and services, the significance of energy within the budgets of both households and businesses has been a particularly challenging aspect of this cost crisis.

The rise in inflation also presents particular challenges to the Scottish budget. Whilst stronger inflation has led to stronger tax receipts via higher nominal earnings growth, particularly for Income Tax, due to the operation of the Fiscal Framework, unlike for the UK Government, this does not automatically result in more funding for the Scottish Budget. Instead, the vast majority of the Scottish Budget funding is still tied to the Block Grant and hence directly influenced by fiscal policy decisions by the UK Government – particularly around the level of public sector spending at a UK-wide level.

Consequently, the Scottish Government has been fully exposed to inflationary risks on devolved expenditure but, instead of protecting our budget from inflation, the UK Government is instead focused on cutting public services to pay for UK-wide tax cuts. This means that our block grant funding from the UK Government is falling in real terms.

Economic resilience

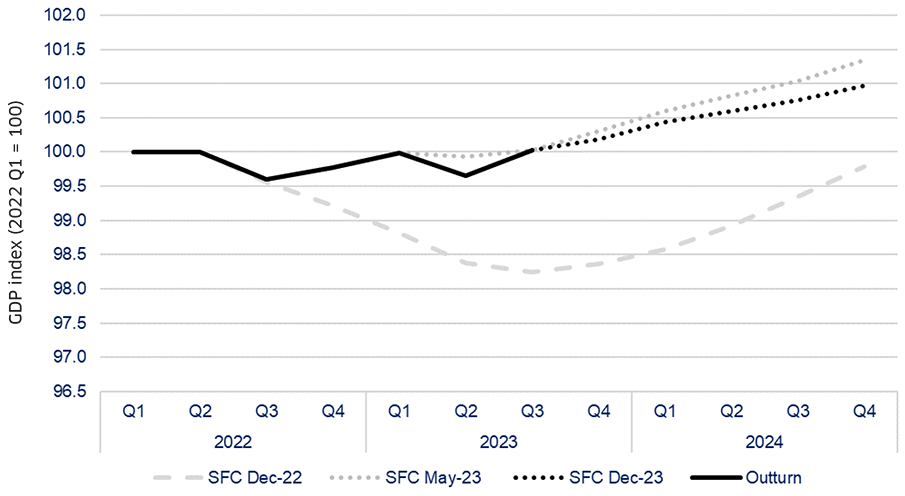

Despite these challenges, the Scottish economy has proven more resilient in 2023 than was previously forecast. In December 2022, the economy was forecast to fall into recession, but instead it has continued to grow, albeit weakly. The labour market has been particularly resilient with employee numbers at a record high and average earnings in Scotland growing faster than the UK.

However, expectations are that economic growth will remain weak, with the SFC now forecasting growth of 0.7 per cent in 2024. The rise in interest rates is playing an increasing role in slowing economic activity as cost challenges continue to impact on household budgets and business investment decisions. This reflects a stalling in the recovery from the pandemic as the economic output has remained broadly unchanged at 0.9 per cent above its pre-pandemic level since the start of 2022.

| £ million | Unemployment Rate (%) | Nominal Average Earnings Growth (%) | Real GDP Growth (%) |

|---|---|---|---|

| SFC Dec-23 | 3.7 | 6.6 | 0.2 |

| SFC Dec-22 | 4.3 | 4.1 | -1.0 |

Source: Scottish Fiscal Commission (SFC)

While expectations are for weak growth to continue into 2024, inflationary pressures are expected to continue to ease, albeit at a more gradual pace than forecast in May. Underlying weakness in demand is expected to start feeding through to the labour market, with unemployment forecast to increase to slightly more than four per cent, although still remaining low by historical standards. Furthermore, weak global growth and international conflict add to the risks and uncertainty in the global economic outlook, although there are also upsides, particularly given the opportunities for external investment in Scotland and the performance of key export sectors.

However, we cannot escape the fact that the performance of the Scottish economy is still inherently influenced by economic and fiscal policy decisions made by the UK Government. The Scottish Government still only has a limited set of levers it can deploy to weather these economic storms.

Source: Scottish Fiscal Commission (SFC); Scottish Government – GDP First Quarterly Estimate

Strong income tax performance

Despite the economic challenges, Scottish Income Tax receipts have outperformed expectations, and they are expected to make a record contribution to Scottish Government funding in 2024-25.

As we have discussed in previous Medium Term Financial Strategies, underlying Scottish Income Tax receipts underperformed relative to the rest of the UK between 2018-19 and 2020-21, in part due to a downturn in the north-east of Scotland and strong growth in receipts in financial services in the rest of the UK. However, with all regions of Scotland now seeing earnings growing faster than the UK average, Scottish Income Tax is set to grow faster than the UK’s in 2024-25.

This strength in earnings growth means that almost the entire gap in performance for Income Tax is set to be closed next year. In 2022-23, the gap in Income Tax receipts caused by economic underperformance was £1 billion. It is now set to fall to £42 million in 2024-25.

This strength in Income Tax receipts means that Income Tax is contributing £1.4 billion to the net funding position in 2024-25.

Latest economic forecasts

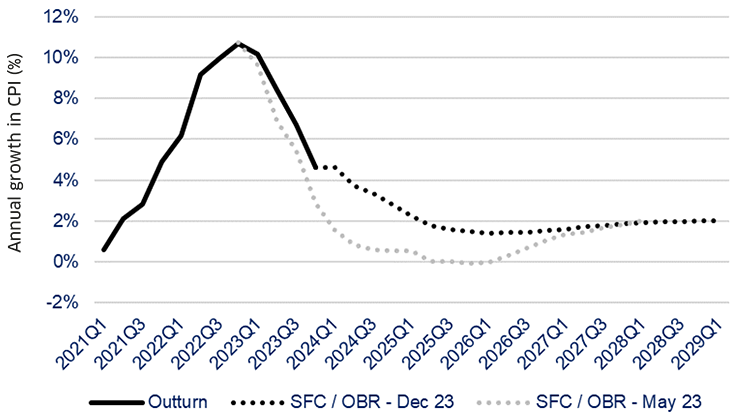

Inflation

While inflation has now more than halved since its recent peak – falling from 11.1 per cent in October 2022 to 4.6 per cent in October 2023 - it still remains notably higher than in recent years with the latest forecasts indicating that it will continue to remain higher for longer.

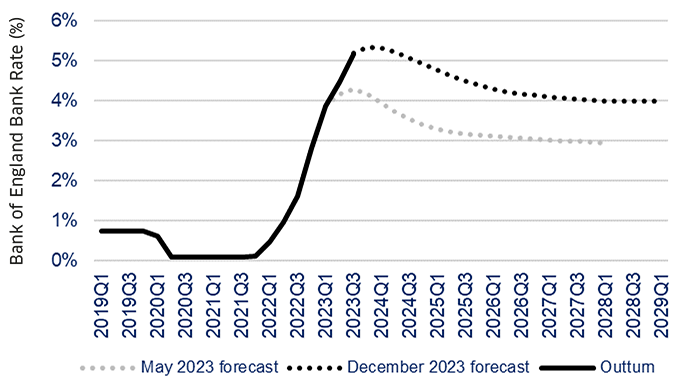

The Scottish Fiscal Commission continue to mirror the latest inflation and interest rate outlook set by the Office for Budget Responsibility alongside the UK Autumn Statement. The outlook is for inflation to be more persistent than in their previous forecasts not falling back to the Bank of England’s target rate of two per cent until 2025 – around a year and a half later than they were anticipating in May.

Source: Scottish Fiscal Commission (SFC); Office for Budget Responsibility (OBR)

Consequently, the OBR is also expecting interest rates to remain higher for longer. In May, the OBR forecast interest rates were to fall to around three per cent by 2026 whereas now it is forecast for interest rates to settle at around four per cent and remain there.

Source: Scottish Fiscal Commission (SFC); Office for Budget Responsibility (OBR)

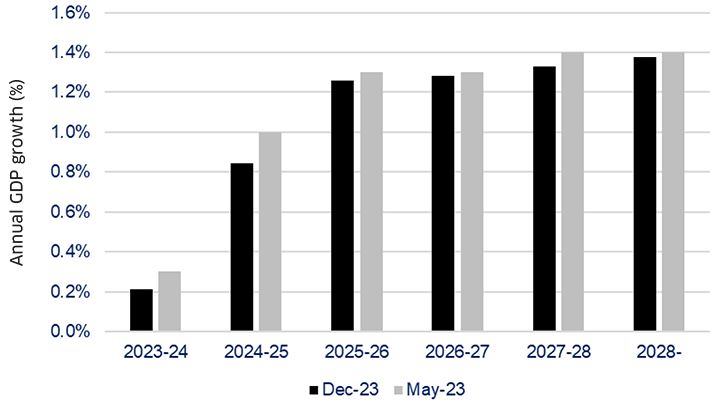

Economy

Given the outlook for higher inflation and interest rates relative to their last set of forecasts back in May, the SFC has revised down their forecasts for economic growth in the short term – although the outlook over the medium term remains largely unchanged.

Source: Scottish Fiscal Commission (SFC)

The SFC are also still forecasting for growth in living standards to remain subdued in the short term, growing only 0.1 per cent in 2024-25 after a cumulative 2.7 per cent fall between 2021-22 and 2023-24 and to not return to 2021-22 levels until 2026-27.

However, the SFC expect the Scottish labour market to remain relatively resilient, with employment growing strongly in 2023-24 despite the economic headwinds and for unemployment to continue to remain near historic lows across the forecast horizon.

| Percentage (%) | 2023-24 | 2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 |

|---|---|---|---|---|---|---|

| GDP Growth | 0.2 | 0.8 | 1.3 | 1.3 | 1.3 | 1.4 |

| GDP per Capita Growth | 0.0 | 0.7 | 1.1 | 1.2 | 1.2 | 1.3 |

| Average Earnings Growth | 6.6 | 3.6 | 3.0 | 2.9 | 3.0 | 3.1 |

| Growth in Living Standards* | -0.2 | 0.1 | 1.6 | 1.8 | 1.9 | 2.1 |

| Employment Growth | 0.5 | -0.1 | 0.1 | 0.2 | 0.3 | 0.3 |

| Unemployment Rate | 3.7 | 4.0 | 4.2 | 4.2 | 4.1 | 4.1 |

| Bank Rate** | 5.1 | 5.0 | 4.4 | 4.2 | 4.0 | 4.0 |

| Inflation Rate*** | 6.1 | 3.0 | 1.6 | 1.5 | 1.8 | 2.0 |

* Real Household Disposable Income (RHDI), per person (total population) (used as a measurement of living standards)

**Bank of England Interest Rate

*** Consumer Prices Index (CPI)

Source: Scottish Fiscal Commission (SFC)

Furthermore, high inflation and a resilient labour market have meant strong growth in nominal earnings, although they have only recently begun growing again in real terms.

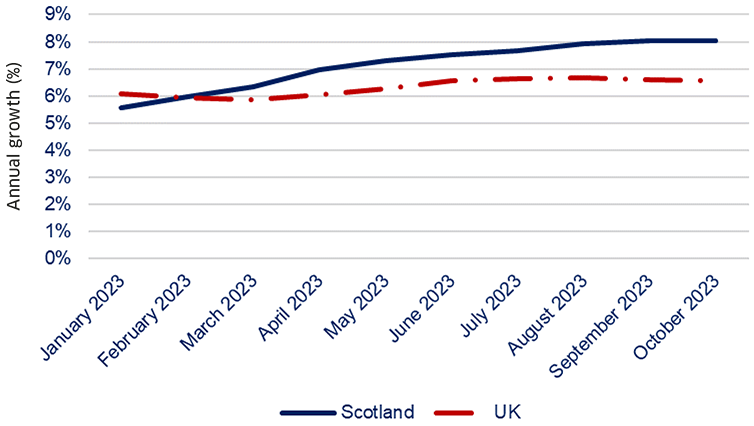

As highlighted by the SFC, earnings in Scotland are currently growing faster than the UK average and the SFC expect Scottish earnings to outperform the UK’s this year and next. Beyond 2025-26, the outlook is more uncertain.

Source: Office for National Statistics (ONS): Rolling Average Annual Growth Rate of Mean Pay from HMRC PAYE RTI data

Summary of the economic and fiscal outlook

Despite the scale of the economic headwinds in 2023 from the energy price shock and cost of living crisis, the Scottish economy has proven to be more resilient than forecast in December 2022.

Scotland’s labour market continues to perform strongly. Scotland has recently seen faster earnings growth than the UK and lower levels of unemployment, both of which are forecast to continue over the medium term meaning our tax policies are set to contribute record amounts of funding for public services.

However, the medium-term period is still forecast to remain challenging, with relatively subdued growth in 2024 and households still facing record falls in living standards which are not forecast to recover to pre-pandemic levels until 2026-27.

Despite the relative resilience of the Scottish economy, we remain tied to a UK economic and fiscal model at a time of extraordinary inflationary pressures on public services. Whilst we continue to take decisions to protect and invest in public services, our budget is still lower in real terms than it was in 2022-23, with the UK Government prioritising tax cuts over protecting public services against inflation.

Footnotes

1 Scottish economic insights: November 2023 - gov.scot (www.gov.scot)

2 Economic and fiscal outlook – November 2023 - Office for Budget Responsibility (obr.uk)

Contact

Email: ScottishBudget@gov.scot

There is a problem

Thanks for your feedback